Net sales refer to the total revenue your business generates as a result of selling its goods or services. Dobson Books Company sells textbook sets to primary and high schools. In the past year, he sold $200,000 worth what are unbilled receivables how to account for unbilled ar of textbook sets that had a total variable cost of $80,000. Thus, Dobson Books Company suffered a loss of $30,000 during the previous year. Furthermore, a higher contribution margin ratio means higher profits.

How Important is Contribution Margin in Business?

Once you calculate your contribution margin, you can determine whether one product or another is ultimately better for your bottom line. Still, of course, this is just one of the critical financial metrics you need to master as a business owner. As you can see, contribution margin is an important metric to calculate and keep in mind when determining whether to make or provide a specific product or service. Managers then use the analysis to evaluate potential acquisitions and to determine which products should be sold and which should be terminated.

Great! The Financial Professional Will Get Back To You Soon.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10).

What is the approximate value of your cash savings and other investments?

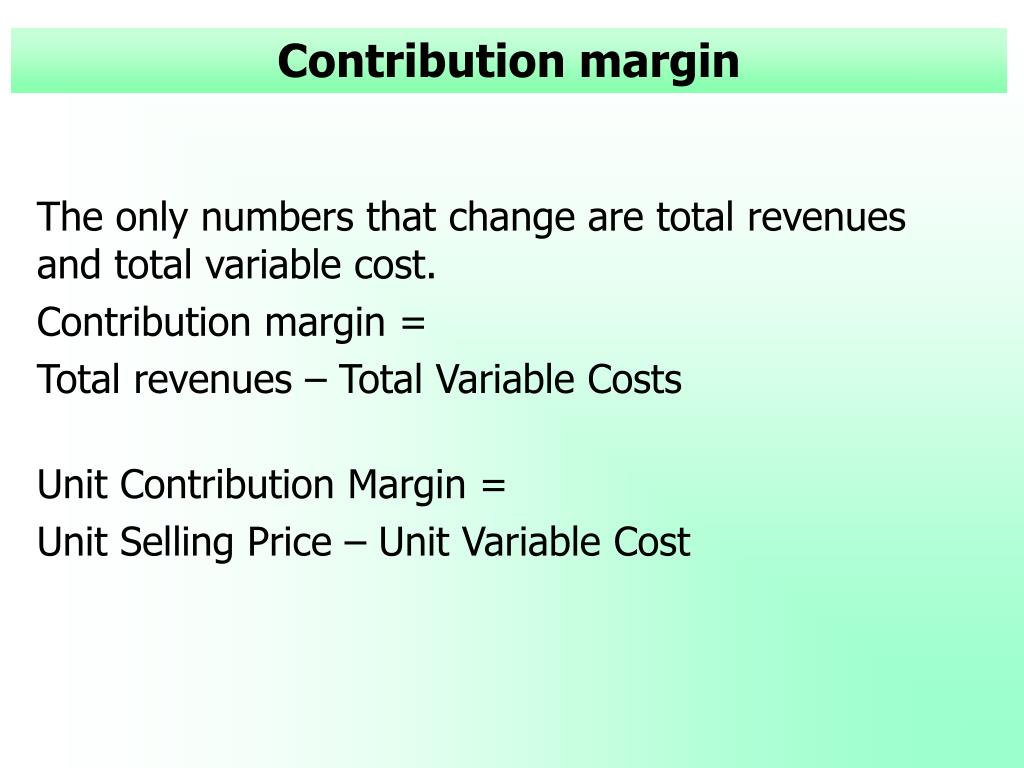

Contribution margin (CM) is a financial measure of sales revenue minus variable costs (changing with volume of activity). After variable costs of a product are covered by sales, contribution margin begins to cover fixed costs. Two ways a company assesses profits are gross margin and contribution margin.

Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. A mobile phone manufacturer has sold 50,000 units of its latest product offering in the first half of the fiscal year.

Can Contribution Margin be Negative?

In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit. You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. At a contribution margin ratio of \(80\%\), approximately \(\$0.80\) of each sales dollar generated by the sale of a Blue Jay Model is available to cover fixed expenses and contribute to profit.

- Once you calculate your contribution margin, you can determine whether one product or another is ultimately better for your bottom line.

- One reason might be to meet company goals, such as gaining market share.

- Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business.

It means there’s more money for covering fixed costs and contributing to profit. Yes, the Contribution Margin Ratio is a useful measure of profitability as it indicates how much each sale contributes to covering fixed costs and producing profits. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales.

The following examples show how to calculate contribution margin in different ways. However, it may be best to avoid using a contribution margin by itself, particularly if you want to evaluate the financial health of your entire operation. Instead, consider using contribution margin as an element in a comprehensive financial analysis. A negative contribution margin tends to indicate negative performance for a product or service, while a positive contribution margin indicates the inverse. This is one reason economies of scale are so popular and effective; at a certain point, even expensive products can become profitable if you make and sell enough.